life insurance/LTC

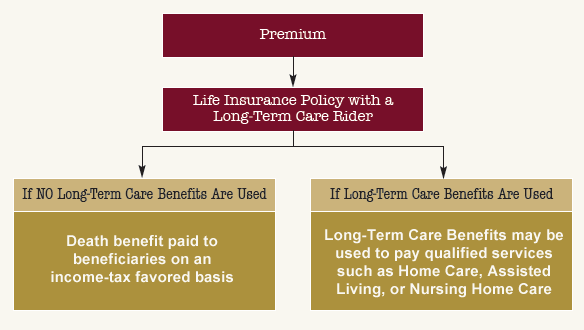

- Helps you pay for long-term care if you need it.

- Provides an income tax-free death benefit if you don’t.

- Plans offered with a money back guarantee.

- A way to help protect your retirement income from the risk of long-term care expenses.

|

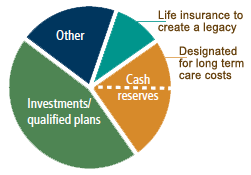

Chances are much of your retirement income will be based upon the assets you’ve accumulated during your working years. Your portfolio may include qualified plans; investments for growth and income; life insurance to efficiently provide for your beneficiaries; and cash reserved for various emergencies, including long-term care. |

| Life Insurance With Long Term Care Rider may help free some of those reserves to seek additional growth, while helping you prepare for the need for longterm care at the same time. | |

|

|

| Can provide the dollars needed to reimburse long term care costs – tax free. | Provides and income tax-free death benefit to your beneficiaries. | Provides a money back guarantee through the Return of Premium Rider.* |

*Terms and conditions vary by company and product. Different companies have different options and offer different benefits. Consult literature for specifics.

You can reposition existing money such as CDs, Money Market, Savings, or you can 1035 exchange an existing universal/whole life insurance policy.

Funding for Life/LTC can be done with: Single premium (one-time pay), 10-pay (you pay for 10 years), or lifetime pay. Companies differ on funding options and also differ on cost and how they structure the death benefit and long term care benefits.

Contact us to find out if this is appropriate for your needs. This product requires life insurance and LTC health underwriting.

Q: What has changed since the Pension Protection Act?

A: Read about these changes here. (new window)

Q: How does this work?

A: Most clients simply reposition money from an existing CD, Money Market, Savings Account or an existing cash-value life policy. When you need long term care you will have long term care benefits.

Q: Can I use my IRA money or one of my old 401k's to fund the Life/LTC policy?

A: For ages over 59 1/2. Underwriting required. If available in your state, you can do a 1035 exchange or "trustee to trustee transfer" to reposition the money to fund the policy from a 401k/IRA account, even from multiple qualified accounts. You can use up to 60% of your entire qualified money. Also spouses can share benefits with one spouses qualified money, even if one spouse is under 59 1/2. Unlike the Annuity/LTC, using qualified money means your LTC benefits and death benefit are not taxable.

Click for a description of Qualified vs Nonqualified Money (new window)

Q: I have an existing cash-value life policy, can I do a 1035 exchange?

A: Yes, it would be simply a rollover from an existing cash-value life policy.

Q: How much is the long term care benefit?

A: It depends on the type of life policy and is usually a % of the death benefit.

Q: Is this available to anyone, everywhere?

A: Since availability changes check with us about current state and age availablilty.

Q: How do I find out if this is right for me?

A: Thousands of Americans just like you have decided to protect their nest egg and have long term care benefits with our Life/LTC. Call us, email us or fill out our online form and one of our licensed specialists will answer all your questions.