LTC insurance

These benefits are part of a Long Term Care Insurance policy and consist of four major parts:

- Daily Benefit

- Coverage Period

- Inflation Protection

- Waiting Period

LTC insurance helps manage three significant retirement risks:

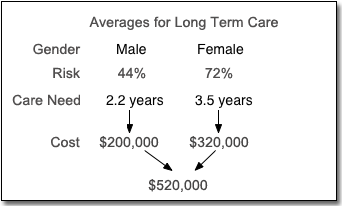

1. Health expense risk. Long-term care expenses – which aren’t covered by Medicare – could consume hundreds of thousands of retirement dollars.

2. Longevity risk. Ever-lengthening life expectancies, enabled by medical advances, increase the likelihood of needing long-term care services at some point in our lives.

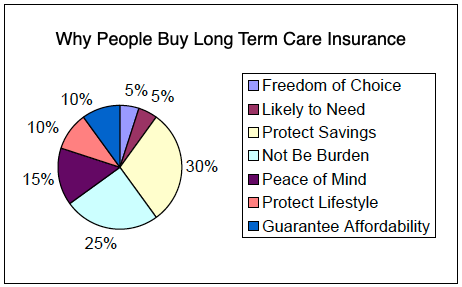

3. Lifestyle risk. Long-term care needs pose more than a financial risk. They also jeopardize clients’ ability to enjoy the quality of life they deserve – whether that’s with home health care or at a care facility.

You have 5 options for financiing long term care.

1. Self-insure : pay out-of-pocket

2. Medicaid : requires poverty level assets/income.

3. Long term care insurance : high leverage, Medicaid protection in most states.

4. Life insurance with a long term care rider : money up front, return of premium.

5. Annuity with a long term care rider : with limited underwriting, an option for those with health issues.

Long term care planning can protect your income stream -- you might say that long term care planning provides the peace of mind that in the event that you need extended care your family's lifestyle could remain intact.

Only traditioinal long term care insurance qualifies for Partnership asset protection, Life/LTC and Annuity/LTC do not qualify, neither do older policies sold before your state adopted Partnership, this includes policies sold by AARP and other marketing outlets.

When you complete the Custom Quote request you will be scheduled to use screen-sharing technology where you can see premiums from different companies so you can choose the plan that’s right for you! There's no pressure and no obligation.

If you have been declined for long term care insurance or have health issues, read about the Annuity with LTC benefits – medical underwriting can be less strict. Remember, it's better to insure a year early than a day late!